Bitcoin Long-Term Holders Slow Down After 700,000 BTC Selloff, Reversal Sign?

On-chain data shows the Bitcoin long-term holder selling pressure has been running out recently after an extended selloff from the group.

Bitcoin Long-Term Holders Have Sold Huge In Past 4 Months

As analyst James Van Straten explained in a post on X, the long-term holders have massively reduced distribution during the last ten days. The “long-term holders” (LTHs) here refer to the Bitcoin investors carrying their coins since more than 155 days ago.

The LTHs comprise one of the two main divisions of the BTC sector, with the other cohort known as the “short-term holders” (STHs). The STHs are naturally the investors who bought within the past 155 days.

Statistically, the longer an investor holds onto their coins, the less likely they become to sell at any point. As such, the LTHs represent the more committed part of the BTC market.

The STHs, on the other hand, are fickle-minded hands who may sell at the first sight of any FUD or profit-taking opportunity. As such, selling from the STHs is usually not that noteworthy. However, Selloffs from the LTHs can be something to watch for, as they rarely occur.

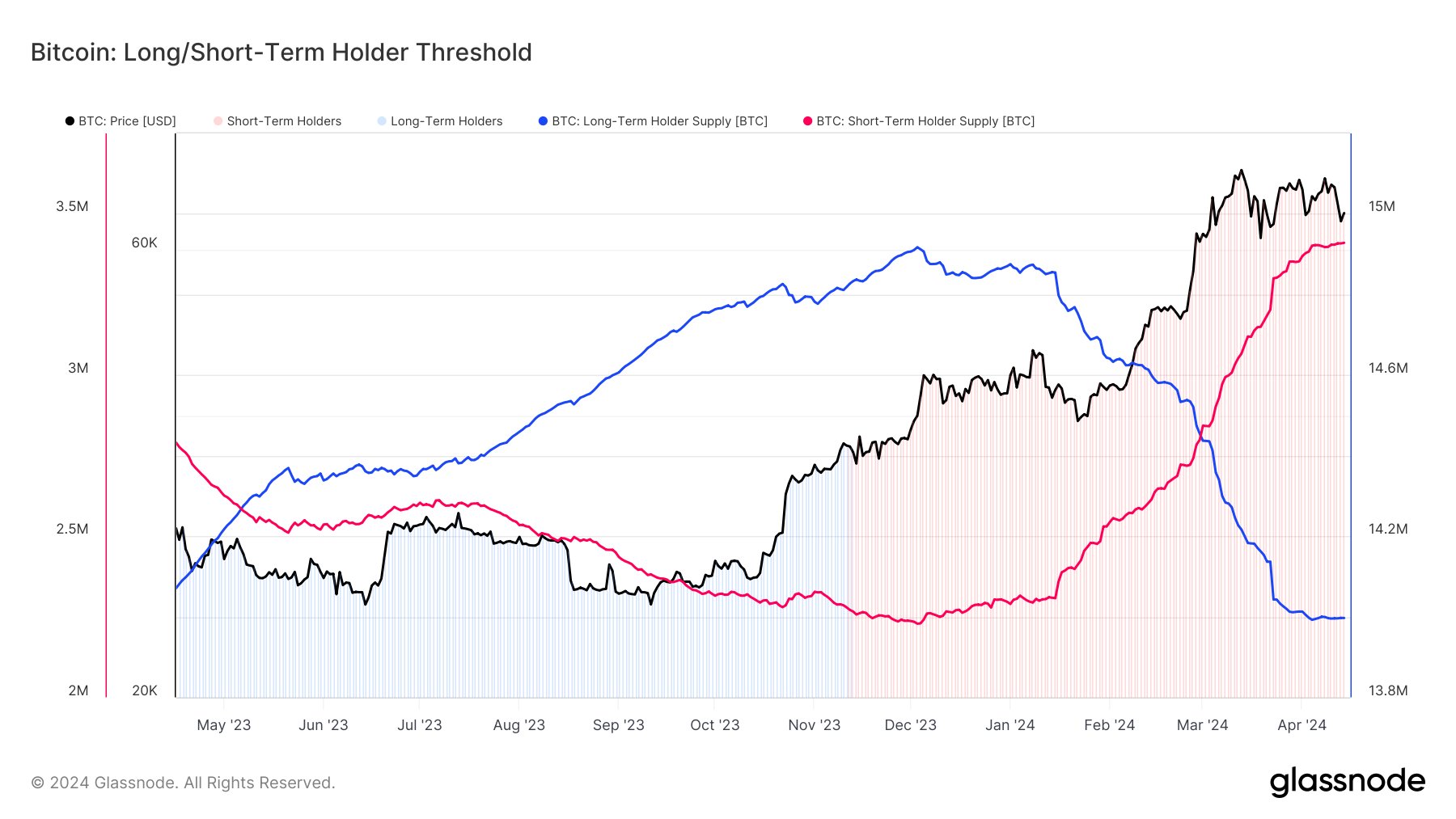

One way to track the behavior of these Bitcoin cohorts is through the total amount of supply they carry in their respective combined wallets. The chart below shows the STH and LTH supply trend over the past year.

As displayed in the above graph, the supply of Bitcoin LTHs increased through most of 2023. At the same time, the supply of STHs naturally decreased.

Something to note here is that this increase in the LTH supply didn’t mean that these HODLers were buying then. Instead, some STHs bought 155 days ago and have finally held long enough to qualify for the cohort.

Thus, there is a 155-day delay between accumulation and the increase registered in the LTH supply. When it comes to selling, though, no such time lag exists, as the LTHs who transfer coins on the blockchain immediately eject from the group and become part of the STHs.

The chart shows that this trend of the supply of these diamond hands going up flipped this year, and the LTHs have been selling instead. In the past four months, these investors have distributed 700,000 BTC.

This excludes the selloff from Grayscale Bitcoin Trust (GBTC), which has constantly been bleeding coins since the US SEC approved the spot exchange-traded funds (ETFs) in January. These coins had also matured enough to become part of the LTHs.

Recently, as the price has gone through some bearish action, the LTH supply has flatlined, implying that the selling from these HODLers has finally stopped, at least for now. Given this new trend, it now remains to be seen how BTC’s value develops from here.

BTC Price

Following the latest drawdown in Bitcoin, its price has dropped towards the $63,200 level.