Here’s Why Dogecoin Is Poised For A Major Bullish Reversal

The Dogecoin (DOGE) price appears primed for a significant bullish reversal, supported by technical indicators and market sentiment data. Despite recent downward pressures, several factors suggest a potential upward trajectory for the popular memecoin.

#1 Dogecoin Bounces Off Key Support Level (1D Chart)

Crypto analyst CRG (@MacroCRG) highlighted the resilience of Dogecoin and PEPE, another prominent memecoin, stating, “DOGE + PEPE both bouncing from important areas. The memecoin demise is greatly exaggerated IMO. Next leg up gonna take many by surprise.”

CRG’s technical analysis reveals that DOGE has maintained a daily close above the critical support level of $0.385 for nine consecutive days, despite substantial selling pressure. Similarly, PEPE has sustained crucial support, indicating that the “memecoin season” might be making a comeback imminently.

For Dogecoin, the short-term resistance zone at $0.42 remains a pivotal level. CRG suggests that a break above this threshold could signal the onset of a new bull run, potentially catching many investors off guard.

#2 Bullish Market Structure (4-Hour Chart)

Further technical insight comes from crypto analyst Gonzo (@GonzoXBT), who provided a technical breakdown of Dogecoin’s price action. Gonzo explained, “DOGE 4H EMA100 -> acting as resistance 4H EMA200 -> acting as support. Until we flip 4H EMA100 we will just chop in between, don’t want to see it lose 4H EMA200 tho.”

This analysis underscores the importance of the 4-hour exponential moving averages (EMAs) in determining short-term price movements. The 4H EMA100 currently serves as a resistance level, while the 4H EMA200 offers support. A sustained breach above the 4H EMA100 could facilitate an upward breakout, whereas a failure to maintain above the 4H EMA200 might lead to further consolidation or decline.

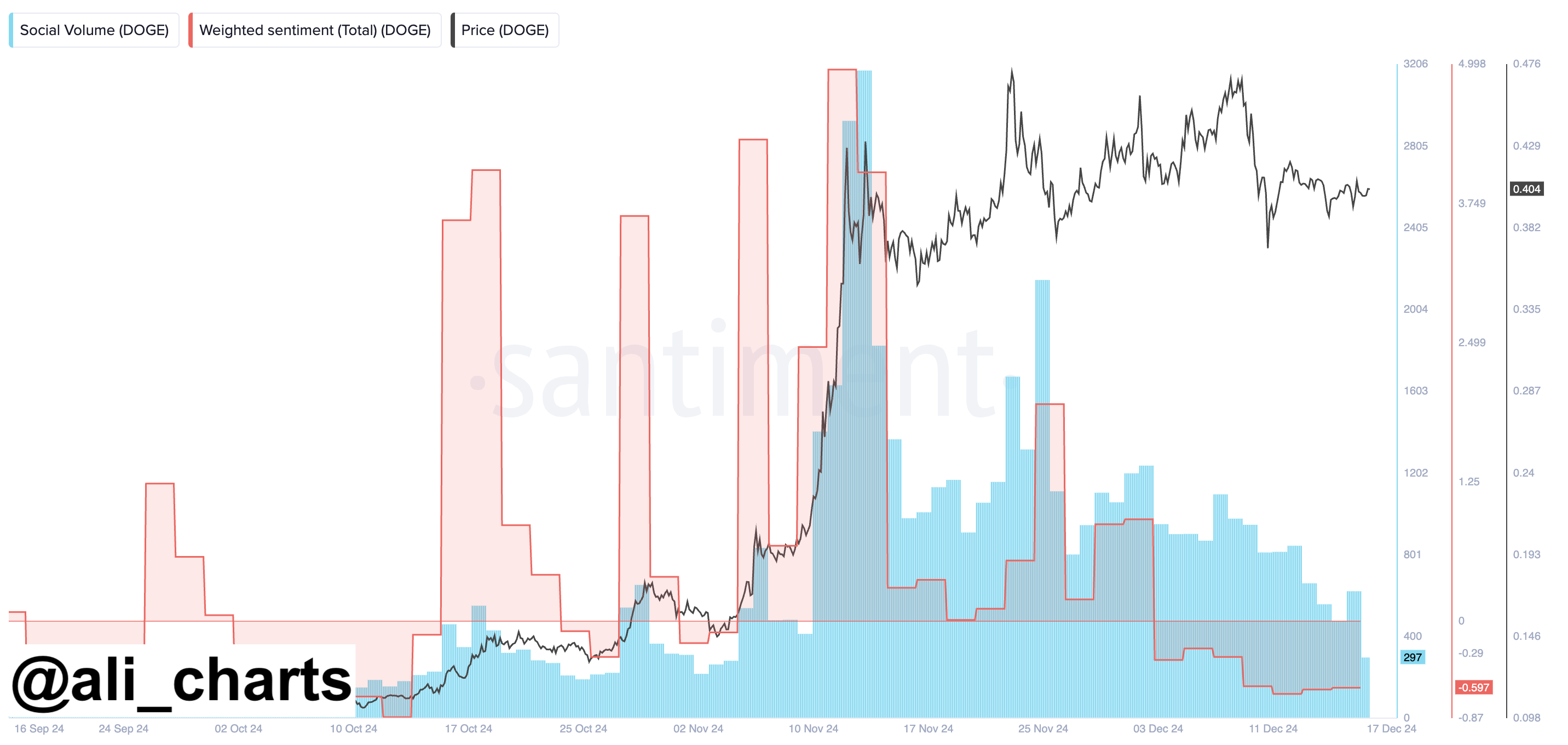

#3 Trading Against The CrowdCrypto analyst Ali Martinez (@ali_charts) presented another bullish perspective on DOGE’s immediate outlook. He noted, “Market sentiment for Dogecoin has turned negative. It seems as if traders are getting impatient during the ongoing price consolidation!”

Martinez’s analysis, based on Santiment data, indicates a sharp decline in both search volume and Weighted Sentiment. Specifically, Weighted Sentiment has plummeted to its lowest point since mid-October, while search volume has dropped to levels not seen since early November.

Martinez speculated on potential catalysts that could quickly reignite positive momentum for Dogecoin, referencing the establishment of the new US Department of Government Efficiency under the leadership of Elon Musk. He suggested, “Or you can wait the first POPULAR action of the Department of Government Efficiency.”

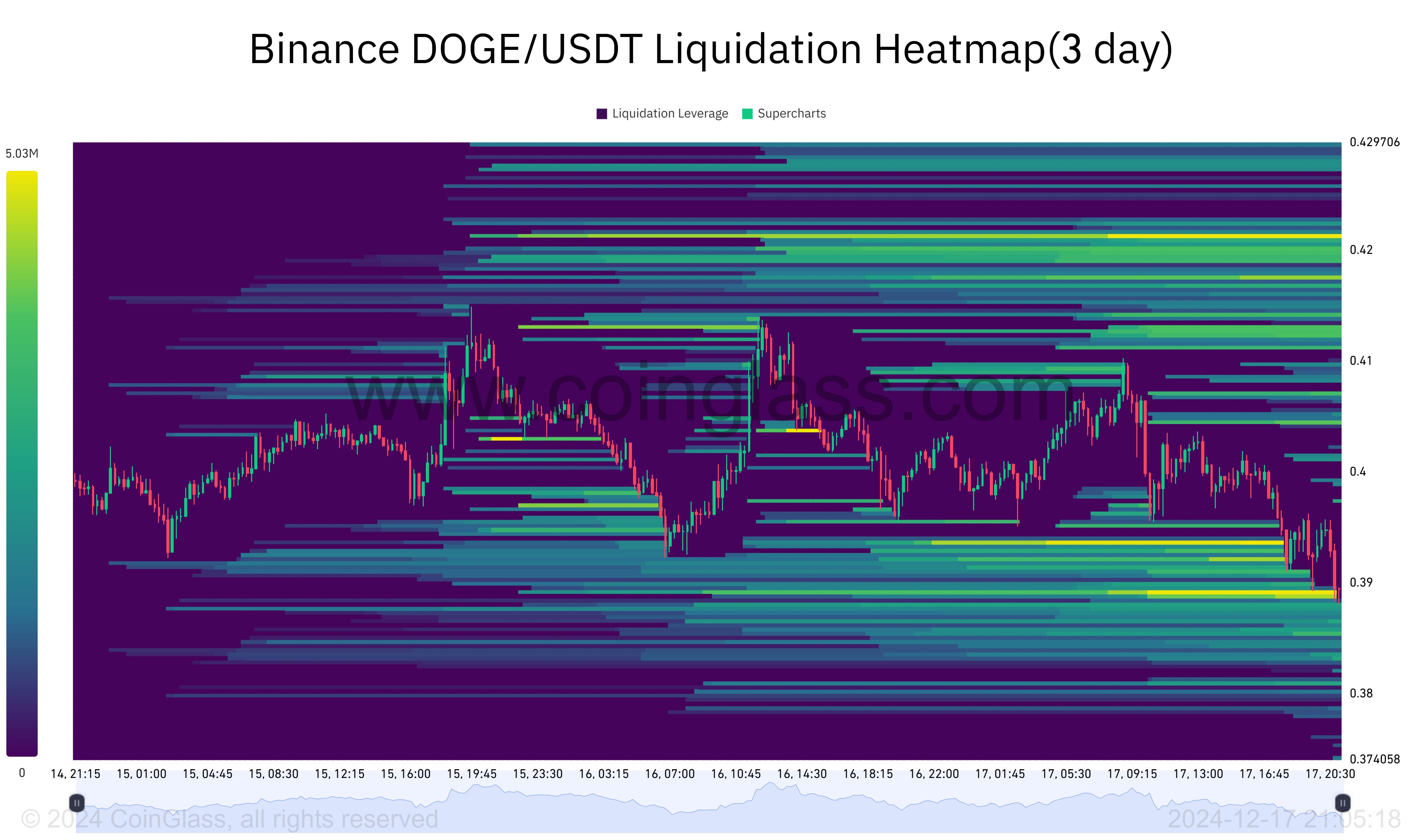

#4 Liquidation Dynamics Indicate Potential UpsideAdding another layer to the bullish thesis, crypto analyst Carlos Garcia Tapia (@CAGThe3rd) shared insights into the liquidation heatmap over the past three days, commenting, “FOMO longs just got liquidated on the 3D chart. DOGE.”

The heatmap by Coinglass illustrates a significant liquidation of leveraged long positions clustered between $0.393 and $0.385 over the past two days. But there’s a bullish caveat: with the majority of longs now liquidated, the remaining liquidation cluster is positioned around the $0.42 mark.

This setup suggests that Dogecoin could experience a bullish candle formation, potentially triggering further liquidations of bearish positions and propelling the price upward. Why? Because liquidation heatmaps are valuable tools in forecasting price movements as they reflect the underlying market liquidity and leverage dynamics.

These heatmaps highlight where traders are most susceptible to forced liquidations, acting as psychological and technical barriers. When the price approaches these levels, large market participants can influence price direction by triggering a cascade of liquidations, thereby amplifying the resultant price movement.

At press time, DOGE traded at $0.3843.