Dogecoin, XRP Flashing ‘Overlooked’ Bullish Signal, Santiment Reveals

The on-chain analytics firm Santiment has revealed that Dogecoin and XRP are flashing bullish signals in an often overlooked metric.

Dogecoin, XRP, & Bitcoin Recently Saw A Decline In Mean Dollar Invested Age

In a new post on X, Santiment has discussed the latest trend in the Mean Dollar Invested Age indicator for a few of the top coins in the cryptocurrency sector.

The “Mean Dollar Invested Age” keeps track of the average age of every dollar the holders have invested into the cryptocurrency. This metric is similar to the Mean Coin Age, an indicator that measures the average age of tokens in the entire circulating supply.

The Mean Coin Age uses on-chain data to determine when every coin was last moved on the network and calculates the mean for the supply based on it. The Mean Dollar Invested Age works on the same data, except that it converts the coins to their USD value based on the price at their last movement.

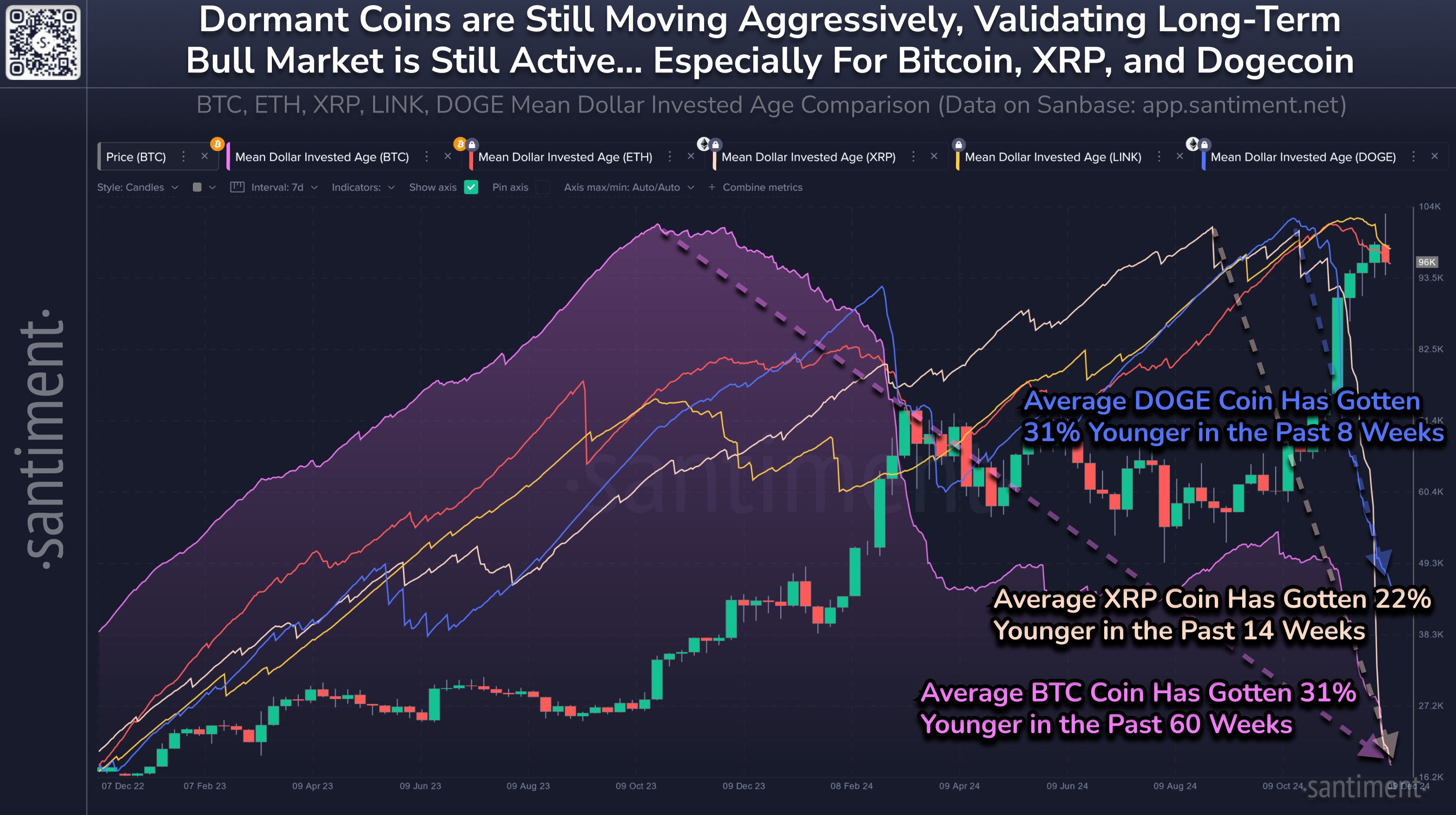

Now, here is a chart that shows the trend in the Mean Dollar Invested Age for five top digital assets: Bitcoin (BTC), XRP (XRP), Dogecoin (DOGE), Ethereum (ETH), and Chainlink (LINK).

As displayed in the above graph, the Mean Dollar Invested Age has registered a decline for all five of these cryptocurrencies recently, but the scale of the drawdown has been quite small in the case of Ethereum and Chainlink.

On the other hand, Bitcoin, XRP, and Dogecoin have witnessed a very significant decrease in the indicator. As for what it means when this metric trends down, Santiment explains:

When a network’s Mean Dollar Invested Age line is moving down, it indicates that older, stagnant wallets (particularly from large key stakeholders) are circulating their dormant coins back into circulation, increasing network activity.

While this suggests that the older hands are potentially participating in selling, another way to look at it could be that new capital is flowing into the market, buying up these dormant coins and bringing the average age down.

Indeed, it seems historically, the pattern has proven to be bullish, as the analytics firm has pointed out:

This is one of the key indicators throughout the history of each coin’s lifespan that helps validate that a bull market can and should continue. The 2017 and 2021 bull markets similarly did not come to a halt until assets’ mean ages started going “up” (getting older) again.

Out of the three assets that have seen a sharp decline in the Mean Dollar Invested Age, Dogecoin has particularly stood out for both the scale and the speed of the drawdown; the average dollar invested into the memecoin has become 31% younger over the last eight weeks.

DOGE Price

At the time of writing, Dogecoin is floating around $0.403, down almost 2% in the last seven days.