6-Figure ‘Treasury Asset’ Bitcoin Price Possible By Year-End—Market Expert

The momentum is on Bitcoin and crypto’s side, and it wouldn’t be surprising if the price surge continues until the end of the year. One of the biggest drivers of the current performance of Bitcoin is the election of Republican Donald Trump.

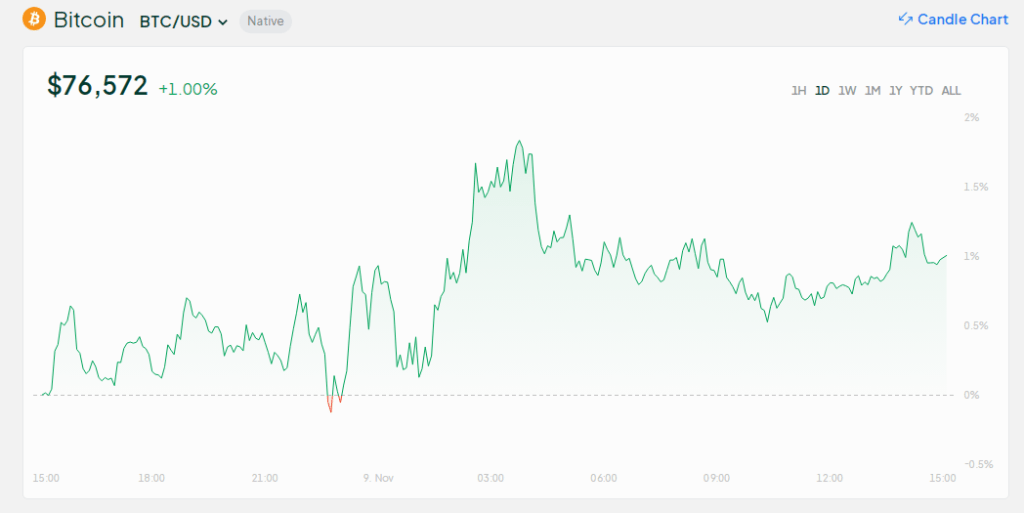

Trump’s rhetoric and friendly pronouncement on crypto helped propel the asset’s price past $76k, beating this year’s March record.

Now, many market analysts remain bullish days after the US elections. Thomas Lee, CNBC contributor and the CIO of Fundstrat Capital, even pushed a bolder claim, saying that Bitcoin could trade in six digits by year’s end. Lee states that the current market and political environment favor the top coin and expects more upside for digital assets.

Trump’s Election Boosts Crypto Industry

This Friday, the Fundstrat Capital CIO shared his thoughts on Trump’s elections and BTC’s future at CNBC’s Squawk Box. In the same discussion, Lee shared that Bitcoin and most altcoins will have a price rally in the short term.

“It’s going to be very difficult to fix the deficit with just changes in taxes and spending,” says @fundstrat‘s Tom Lee. He says bitcoin is “potentially a Treasury reserve asset. If Bitcoin rises in price, it actually helps offset the liabilities, which is the deficit.” pic.twitter.com/tVrnE37dhS

— Squawk Box (@SquawkCNBC) November 8, 2024

Lee shared that right before the elections, the global markets faced plenty of uncertainties. However, with Trump winning the US elections and his favorable proposed policies on Bitcoin, the crypto industry can expect better days.

Lee added that changes in regulations and pro-crypto policies could power the digital asset’s short run. He also credits Trump for his experience as a former president, which can help him better navigate future challenges. With

Trump’s support and a favorable market environment, Lee reflects on his initial target of $150k for BTC, saying this is possible.

Bitcoin, Digital Assets Can Help Offset US Debt

One of Trump’s campaign promises is to cut the country’s growing budget deficit, which now stands at more than $35 trillion. Lee explained that it’s difficult for Trump to cut taxes and spending to address the deficit.

Instead, Lee sees Bitcoin as the key to solving the country’s growing budget deficit. He sees the potential in BTC as a future Treasury asset, noting its increasing market value over the years.

Interestingly, Trump has also explored the idea, saying that as president, he can arrange the country’s budget woes by handing “a Bitcoin check.”

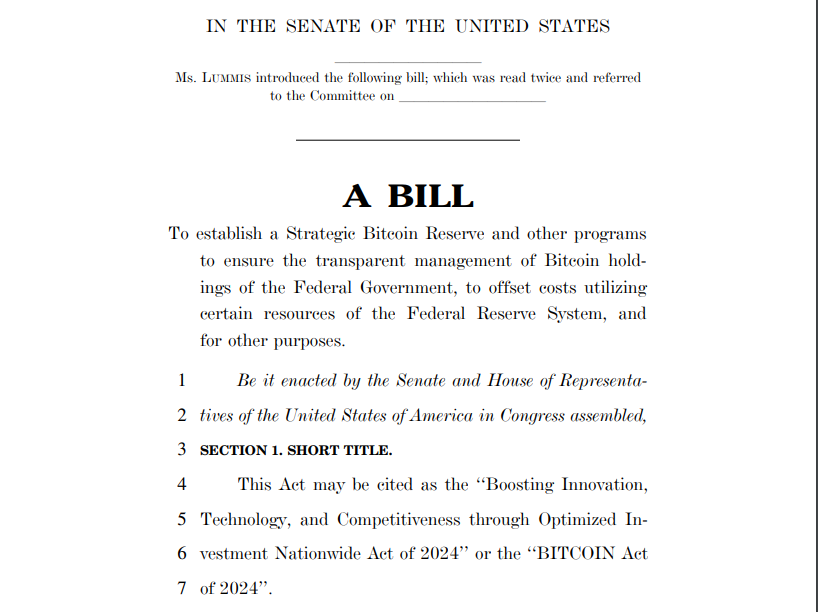

Before Lee’s comments, there had been discussions on Bitcoin’s growing role in the country’s financial system. Senator Cynthia Lummis filed a bill, the Bitcoin Act, to legitimize the crypto asset as an economic asset.

According to Senator Lummis, Trump’s win will favor the push to make Bitcoin an asset to help combat economic uncertainties. One of the bill’s recommendations was to hold up to 1 million BTC over five years as a hedge against inflation.

Featured image from UpFlip, chart from TradingView