Bitcoin ETFs See Historic Surge – Institutions Go Bullish On BTC With $1.38 Billion Record Inflows

Yesterday, Bitcoin had one of its most bullish days in history, skyrocketing past its all-time high to reach $76,990. This new milestone has ignited widespread excitement and confidence among investors, who now see the potential for further gains.

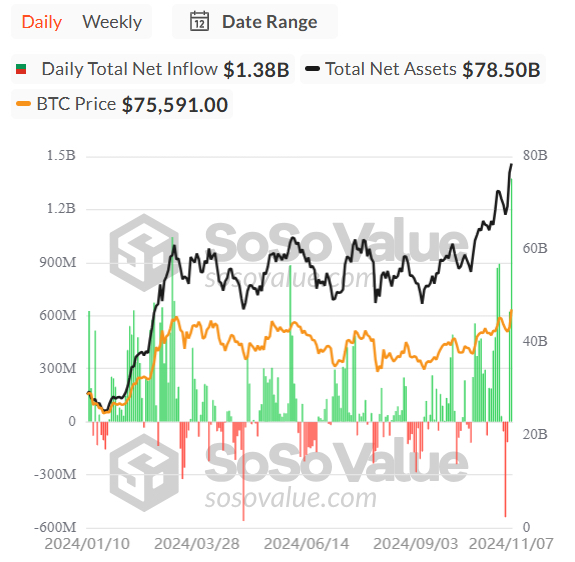

Key data from Carl Runefelt reveals that Bitcoin ETFs experienced a historic surge, with $1.38 billion in net daily inflows. This record-breaking figure highlights institutional demand for Bitcoin, as major players like BlackRock are buying BTC in anticipation of long-term growth.

The influx into Bitcoin ETFs underscores a broader trend of institutional adoption, with increasing interest from financial giants as they recognize Bitcoin’s potential as a store of value and hedge against economic uncertainty. Runefelt’s analysis suggests that this level of demand is unprecedented, marking a turning point that could sustain Bitcoin’s bullish momentum.

The recent surge is not just a technical breakout but also a fundamental shift driven by institutional confidence, setting Bitcoin up for potential further highs as large-scale investors continue to enter the market.

Bitcoin Hits New ATH

Bitcoin has surged into uncharted territory, breaking its previous all-time highs once again to reach a new peak that has captivated the crypto community. This historic rally comes on the heels of the U.S. election, which saw Donald Trump emerge victorious.

Market sentiment suggests that Trump’s pro-crypto stance could have played a role in driving renewed confidence among U.S. investors, who are looking to Bitcoin as a hedge amid changing economic policies.

Adding to this momentum, traditional investors increasingly pour into Bitcoin through ETFs, marking a significant shift in institutional interest. According to key data from SoSo Value, shared by prominent analyst Carl Runefelt on X, Bitcoin ETFs experienced record-breaking daily inflows yesterday, totaling an astounding $1.38 billion.

This historic inflow underscores the growing appetite from institutional players who are viewing Bitcoin as a critical asset for their portfolios.

The recent bullish shift among institutions follows a prolonged 7-month accumulation phase that had cast shadows of doubt over Bitcoin’s potential to break new highs this year. Many investors remained cautious, with market volatility and uncertainty testing their confidence.

With institutional backing at record levels, Bitcoin’s recent rally could signify the beginning of an extended bullish phase. As big players like BlackRock buy-in through ETFs, the market sees this as a signal of renewed strength. All eyes are now on Bitcoin’s next moves, with analysts suggesting the recent price action may only be the beginning of a larger bull run for the world’s largest cryptocurrency.

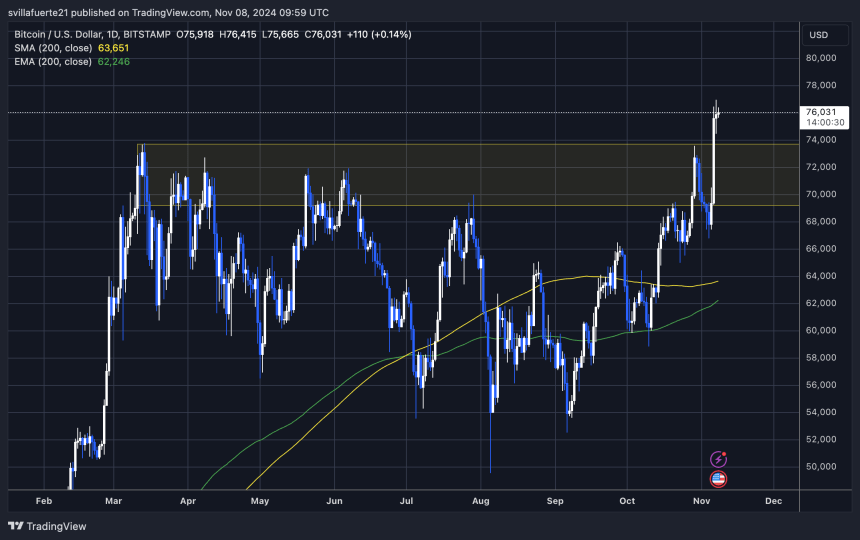

BTC Pushing Up: Strong Price Action

Bitcoin is trading at $76,000 after reaching new all-time highs. BTC is entering a strong consolidation phase above the previous record level of $73,800. This price zone is crucial for bulls, as holding above it could provide stability for Bitcoin’s rally to continue. Analysts are closely watching this level; if BTC can respect it, the bullish momentum may persist, encouraging further gains.

However, the recent euphoria could lead to a consolidation phase just below $77,000—a level some experts identify as a short-term local top. This resistance could take time to overcome as the market digests recent gains and awaits fresh catalysts for another breakout.

Despite potential consolidation, demand remains robust, and on-chain data reflects strong buying pressure that could continue driving the price upward. The technical outlook suggests further upside potential if Bitcoin can stay above $73,800 over the coming days. Bulls are optimistic, as it could establish a solid foundation for the next leg up in Bitcoin’s ongoing rally.

Featured image from Dall-E, chart from TradingView