Will Bitcoin Continue Dumping? This Analyst Thinks So, Here’s Why

Bitcoin is consolidating, struggling for gains, and looking at price action in the daily chart. Even with the rejection of lower prices, the coin has yet to follow through, decisively reversing losses of June 24.

Should Bitcoin Traders Brace For More Losses?

In light of this, one analyst on X thinks there could be more losses in the coming days. Posting on X, the on-chain analyst highlighted a worrying trend: Even amid the Bitcoin trading community’s optimism, sellers are relentlessly stacking up more short orders.

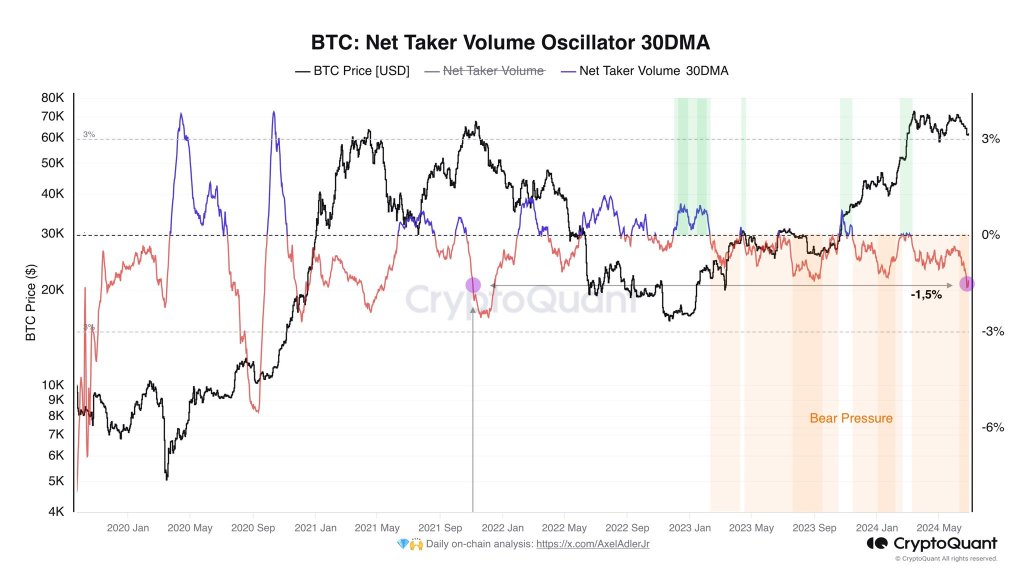

According to the Bitcoin Net Taker Oscillator indicator, the reading is -1.5%. At this level, it is at the same point observed when prices rocketed to as high as $70,000 in November 2021 before dumping sharply throughout 2022.

Bitcoin is trending at a near all-time high, roughly 20% from $73,800 printed in mid-March 2024. Although the uptrend of Q1 2024 defines the current formation, prices are retesting key support levels stacked between $56,500 and $60,000.

If there are deeper losses, as the analyst projects, BTC could crash, reaching $50,000. This development would automatically disqualify the short-squeeze narrative in some quarters.

Compounding the bearish pressure, the analyst also picked out an uptick in long liquidations, rising to 13% as of June 27. The upswing in long liquidations means that leveraged traders across leading exchanges like Binance and OKX are now exiting at a loss.

The analyst added that what’s happening regarding liquidation is similar to events in the 2019-2020 correction. Then, more long traders were liquidated, and within five months, BTC crashed by 46%.

If the past guides, then it is likely that the same could unfold in the coming months. However, the analyst notes that if whales buy over 500,000 BTC, prices will stabilize and shoot higher.

Bearish Sentiment Building Up: Time To Buy Bitcoin?

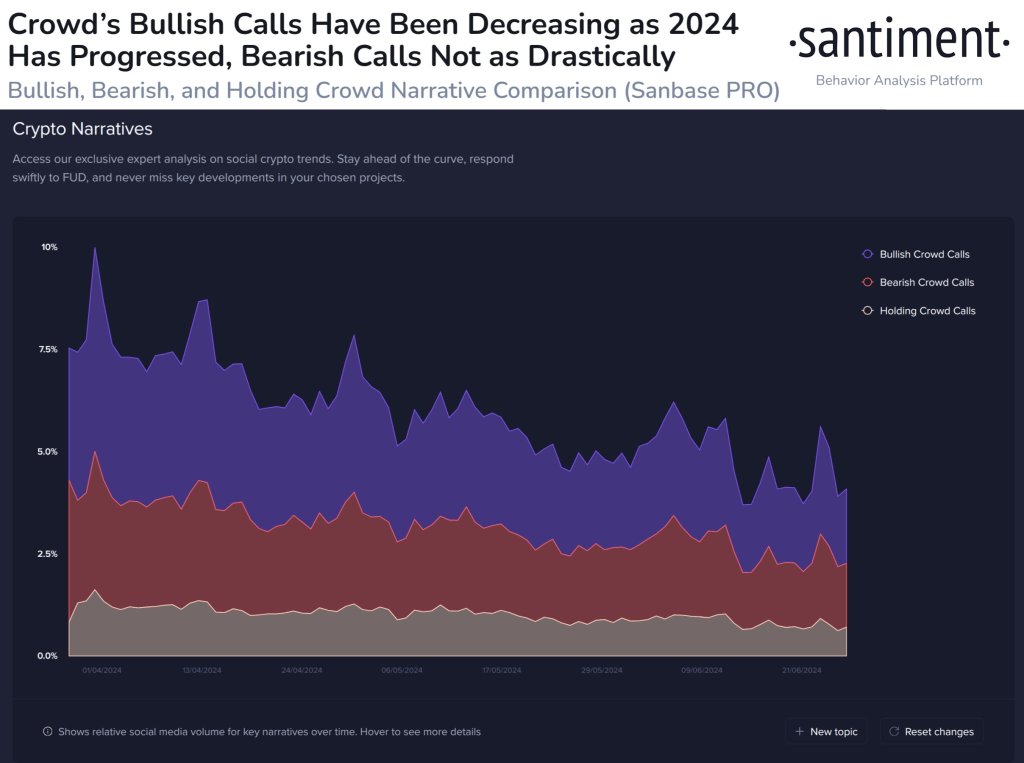

Santiment data also reinforces this bearish narrative. In recent weeks, the number of users and traders expecting BTC to edge higher has been plunging across multiple social media platforms.

Of note, bearish sentiment has been building up since the Bitcoin halving event and the sideways movement of prices since April 2024. Though traders were optimistic ahead of the Halving event on April 20, the failure of prices to breach $74,000 eroded confidence.

Even so, the current bearish sentiment could be a contrarian indicator, especially considering the general resilience of bulls. Prices remain above $60,000, rejecting attempts for lower lows.

Often, declining trader and investor confidence accompany bottoms, a situation seen as of late June. Aggressive traders might view this as a loading opportunity, believing BTC is undervalued at spot rates.